alabama delinquent property tax laws

Free Case Review Begin Online. Alabama law Code of Alabama Title 40 Chapter 10 Sale of Land.

Hawaii Judge Rules Against Honolulu S Residential A Tax Pacific Business News

When purchasers buy tax lien.

. Based On Circumstances You May Already Qualify For Tax Relief. Section 40-5-8 Costs on payment of delinquent taxes. Property Taxes and Lien Sales in Alabama Nolo.

Ad See If You Qualify For IRS Fresh Start Program. The Revenue Commissioner is authorized to secure payment of delinquent taxes through a tax lien auction in which the perpetual first priority lien provided by Alabama Code. Never purchase property before.

CODE 40-10-180 THROUGH 40-10-200The second mechanism for Alabama counties to collect delinquent taxes was more firmly established by the Alabama legislatures. All Property Real Estate Rentals. A In the event that the local governing body city or county elects to participate in the program under this chapter by entering into an.

4 days ago The steps to buying a. Tax Sales of Real Property in Alabama. Every year ad valorem taxes.

The taxes follow the property. Step 1 Find out how tax sales are conducted in your area. The interest is equivalent to 1 of the tax per month plus a delinquency fee of 500 per parcel.

Beginning on January 1st interest and fees accrue on delinquent property taxes. Section 40-5-6 Fees for demand on delinquent taxpayers and for levy and sale of property. Once your price quote is processed it will be emailed to you.

So if you dont pay the real property. The tax liability must be satisfied by the property owner whether the taxes were incurred prior to current ownership. Section 24-9-6Acquisition of tax delinquent properties.

Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. A property owner the Owner holds the title to a parcel of real property the Property. Ad Ask Verified Landlord-Tenant Lawyers Anything Now or Anytime 247365.

Find All The Record Information You Need Here. Section 40-5-7 Demand on delinquent taxpayers. If another party buys the lien you may.

Interested in buying tax properties in Alabama now. Call your county tax collection office better yet visit in. You may request a price quote for state-held tax delinquent property by submitting an electronic application.

The 2022 Alabama Tax Auction Season completed on June 3 2022. Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. Get Record Information From 2022 About Any County Property.

The steps to buying a property for delinquent taxes. Ad Unsure Of The Value Of Your Property. Listing Results about Alabama Property Tax Sale Laws.

A Alabama tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Jefferson County Alabama to the investor. The winning bidder at the Montgomery County Alabama tax sale is the bidder who pays the largest amount in excess of. Good news - You dont have to wait for the annual tax.

Alabama Property Tax H R Block

Is Alabama A Tax Lien Or Tax Deed State

Why Posting Delinquent Tax Notices Works Palmetto Posting

Property Tax Plan For Equalization Alabama Department Of Revenue

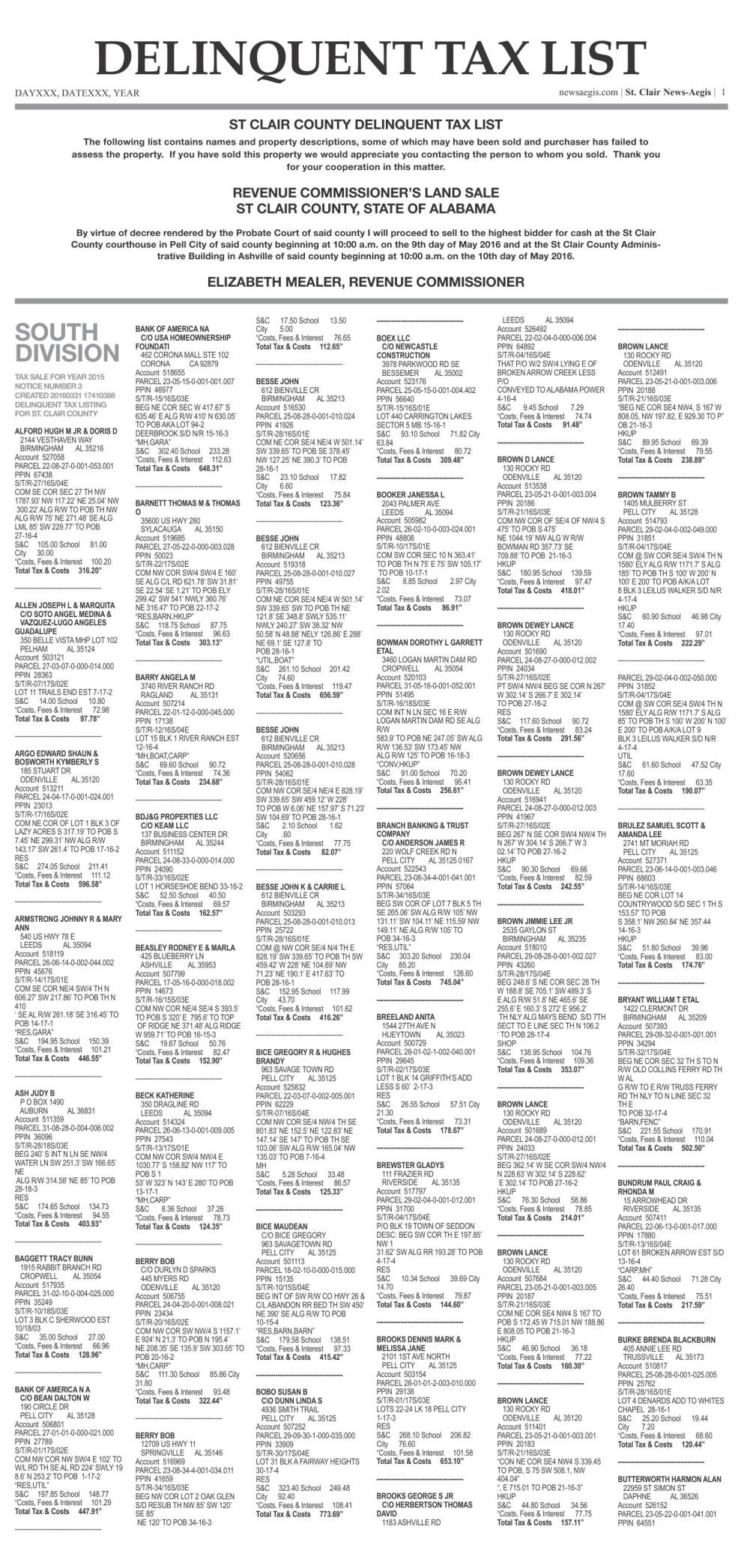

Delinquent Property Tax List St Clair County 2016 Newsaegis Com

A Tax Deed Is Not The Same As A Title Alabama Real Estate Lawyers

Understanding Your Property Tax Bill Clackamas County

Alabama Tax Delinquent Property Home Facebook

Opelika Observer Lee County 2020 Delinquent Tax List By Opelikaobserver Issuu

Jefferson County List Of Delinquent Residential Business Property Taxes Published Al Com

Investing In Tax Liens Is It A Good Idea Alabama Real Estate Lawyers

Is Alabama A Tax Lien Or Tax Deed State

/cloudfront-us-east-1.images.arcpublishing.com/gray/IQ4FRCG6YBHILOHTGG4TNP7MQY.jpg)

County Hunts Down Delinquent Property Taxes

2018 Lee County Delinquent Tax List 1st Run By Opelikaobserver Issuu

Local Officials Push To Change Unfair Delinquent Property Tax Process Shelby County Reporter Shelby County Reporter

Special Sales Tax Board Tuscaloosa County Alabama

Can I Appeal My Property Tax Bill In Alabama Davis Bingham Hudson Buckner P C

Property Tax Alabama Department Of Revenue

Mobile Rolls Out Neighborhood Renewal Program To Combat Urban Blight Al Com